LUWO PROPERTY

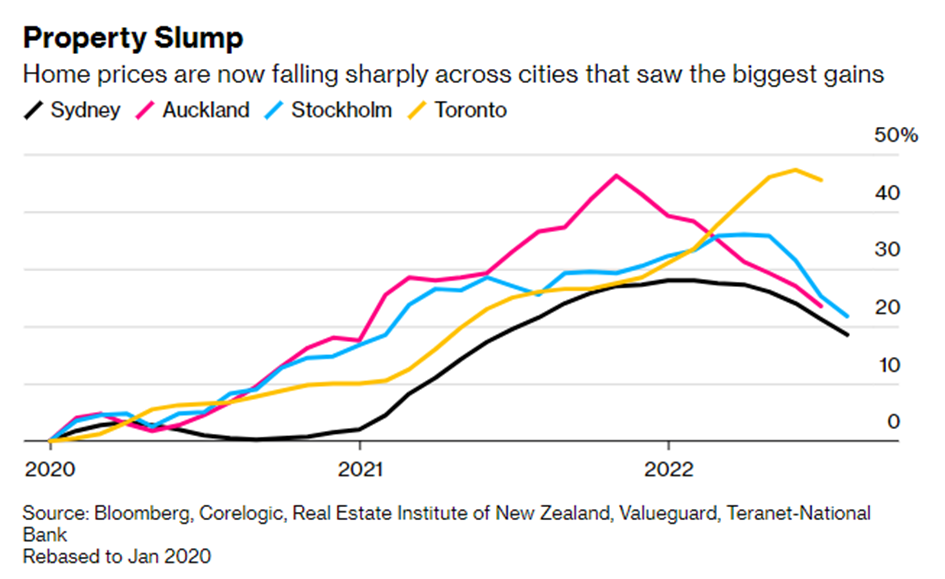

THE WORLD’S HOTTEST PROPERTY MARKETS ARE EXPECTED FOR DOUBLE-DIGIT (%) PRICE DECREASES AS CONSUMERS ARE UNDER INCREASING FINANCIAL PRESSURE.

According to a Bloomberg report, the property market may be in a difficult situation as a result of rising borrowing costs.

From Sydney to Stockholm to Seattle, buyers are pulling back after central banks raise interest rates at their fastest pace in decades, sending property prices down. Meanwhile, millions of people who took out cheap home loans during the height of the pandemic may now face much higher repayments.

The rapid cooling of the real estate market (one of the main sources of household wealth) threatens to worsen the global economic downturn, although the contraction so far does not yet approach the level of the 2008 financial crisis. However, the price drop in the Australian and Canadian real estate markets is already in the double digits, according to economists, the real estate markets of the world are only just starting to go downhill.

“Around 2023-2024 we will see global downturns in real estate markets” – said Hideaki Hirata of Hosei University, a former Bank of Japan economist who co-authored the International Monetary Fund’s study on global housing prices. The expert warns that it will take time for households to feel the full impact of the aggressive interest rate hike. „ Sellers often ignore signs of declining demand” -he told.

Higher real estate financing costs hurt economies in several ways. Households with credit tighten their belts and thus consume less, while rising mortgage rates discourage potential buyers from entering the market, driving down property prices.

More Articles

Recommended Posts

When the topic of property negotiation comes up, there are basically 2 types of people. One type gets chills when they have to sit down and bargain. The other type is convinced that they are the biggest dealers around and can't wait to jump into action. My experience is that whether it is one or the other, the vast majority still fail the negotiation.

In this article, I will share 3 steps with you, which I consider to be the most important and which you can use to maximize the benefit achieved during price negotiations.

Developing markets tend not to like periods of turbulence, when capital seeks a safe haven, for example in America or Switzerland. The last three years have been a cause for concern, with not only pandemic and war but also falling inflation causing major problems.

In its latest quarterly forecast, the Institute of the University of Munich (ifo Institut – Leibniz-Institut für Wirtschaftsforschung an der Universität München e.V.) lowered its growth forecast for this year and next year